invoice vs Receipt - Key Differences

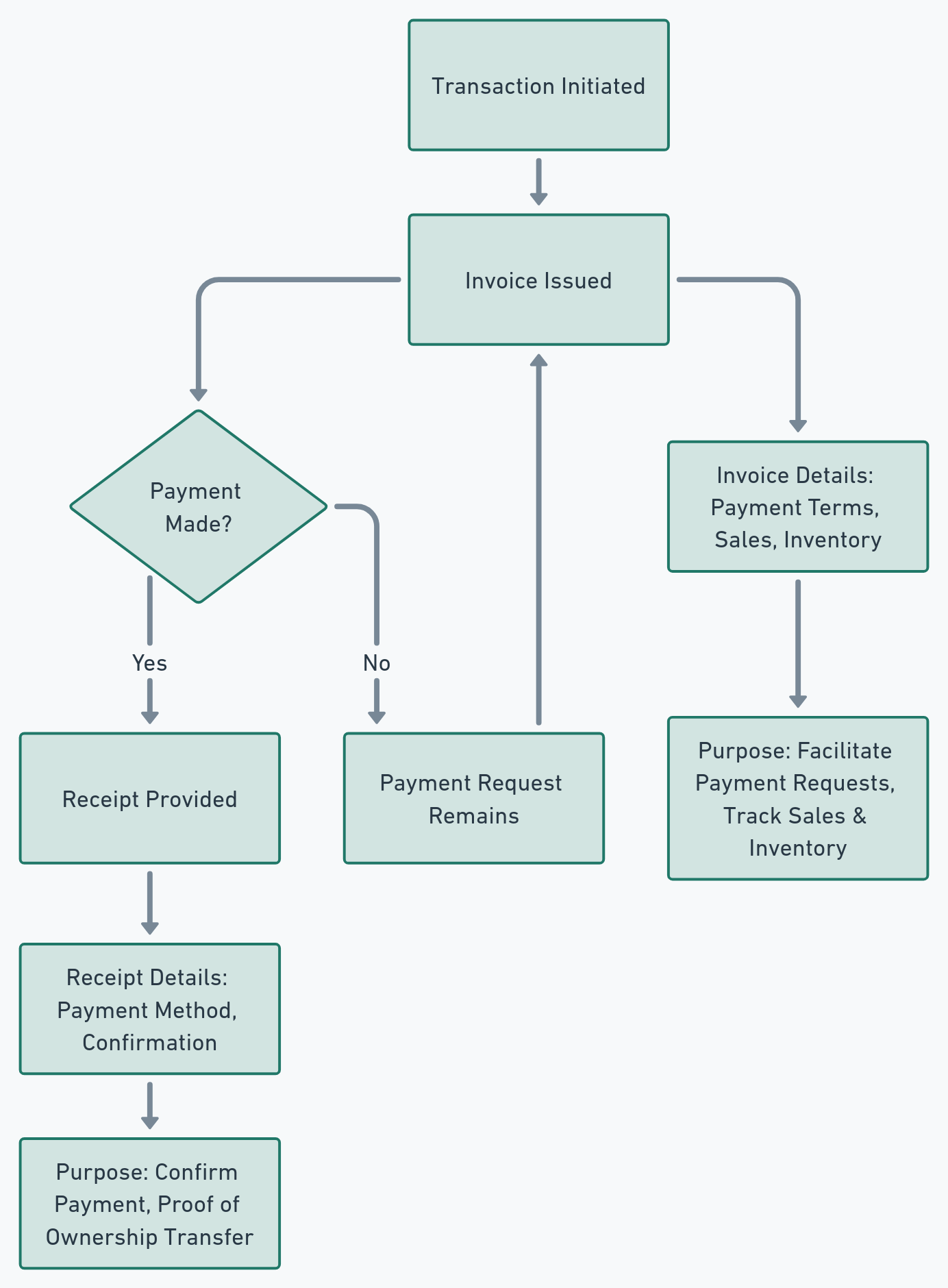

In the world of business transactions, two documents are pivotal: invoices and receipts. Though often used interchangeably, they serve distinct purposes and are used at different stages of the sales process. Understanding these differences is crucial for effective financial and inventory management.

What is an Invoice?

An invoice is a detailed bill sent by a seller to the buyer, usually before the payment is made. It outlines the products or services provided, the amount due, payment terms, and deadlines. Invoices are used by businesses not only to request payment but also to track sales and inventory.

Key Features of Invoices:

- Sent before payment is received.

- Lists items sold, prices, total amount due, and payment terms.

- Acts as a legal document that can be used in disputes.

What is a Receipt?

A receipt, on the other hand, is an acknowledgment of payment received. It provides proof of transaction and is given to the buyer after the payment has been made. Receipts are essential for both parties as they confirm the completion of a transaction and the transfer of ownership.

Key Features of Receipts:

- Issued after payment is complete.

- Confirms the amount paid and the method of payment.

- Serves as proof of purchase for the buyer.

Invoice vs Receipt: The Main Differences

The primary difference between an invoice and a receipt lies in their purpose and the time they are issued. Here's a comparative overview:

- Issuance: Invoices are issued before payment as a request for payment, whereas receipts are provided after payment as proof of the transaction.

- Purpose: Invoices facilitate payment requests and track sales and inventory, while receipts confirm payment and serve as proof of ownership transfer.

- Content: Invoices detail the transaction, including payment terms, while receipts confirm the payment details, including the payment method.

Streamlining Invoice and Receipt Management with Swwitch CRM

Managing invoices and receipts can be cumbersome, especially for small businesses and freelancers. Swwitch CRM offers a seamless solution for creating, sending, and tracking invoices and generating receipts.

Benefits of Using Swwitch CRM:

- Automated Invoice Creation: Generate detailed invoices quickly, ensuring accuracy and professionalism.

- Efficient Tracking: Keep tabs on outstanding payments and manage cash flow more effectively.

- Receipt Generation: Automatically generate receipts upon payment, providing instant confirmation to your customers.

Conclusion

Understanding the differences between invoices and receipts is fundamental for managing business transactions efficiently. While invoices request payment for goods or services, receipts acknowledge the completion of a payment. Leveraging tools like Swwitch CRM can streamline these processes, allowing businesses to focus on growth and customer satisfaction. By automating and managing these crucial documents, Swwitch CRM helps businesses maintain accurate records, ensuring financial health and compliance.

Optimize your financial transactions with Swwitch CRM, simplifying the management of invoices and receipts for your business.

Get Started with Swwitch CRM for Free. Check swwitch.