What is a Proforma Invoice?

Key Insights

- Definition: A proforma invoice is a preliminary bill of sale provided by sellers to buyers before the delivery of goods or services.

- Purpose: It details the items to be sold, their prices, and other transaction terms, serving as a blueprint for the final invoice.

- Importance for Small Businesses: Essential for budget planning, customs clearance on international shipments, and establishing clear buyer-seller agreements.

- Swwitch CRM Advantage: Streamlines the creation and management of proforma invoices, enhancing efficiency and accuracy.

Introduction

Are you scratching your head wondering what the heck a performa invoice is and why it's something you should even care about? Today, we're diving deep into the world of performa invoices, those nifty documents that could make a world of difference in how you handle your business transactions. Whether you're dealing with international clients, securing prepayments, or simply need to outline the terms of a sale before it's finalized, a performa invoice has got your back. In this comprehensive guide, we'll explore what a performa invoice is, why it's a game-changer for small businesses, and how you can create one that ticks all the boxes for your business needs. So, buckle up and get ready to become a performa invoice pro!

What is a Proforma Invoice?

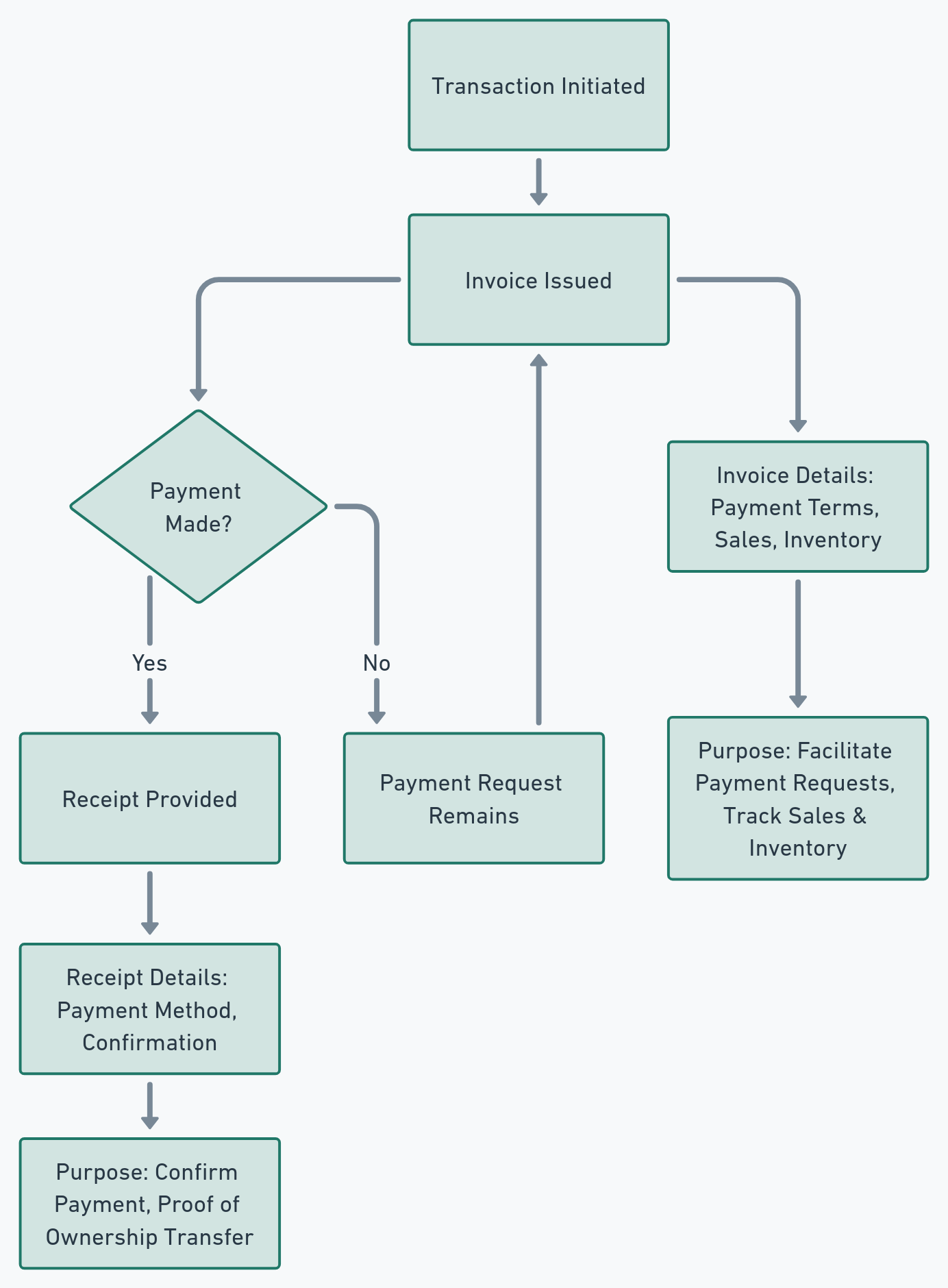

In the realm of small business, understanding the nuances of billing documents is crucial. A proforma invoice stands out as a vital tool, acting not as a demand for payment but as a good faith estimate detailing a sale's proposed terms. It's a precursor to the commercial invoice, the final bill exchanged upon delivery of goods or services.

Purpose and Benefits

- Clarifies Sales Terms: Offers a detailed preview of the sale, helping to avoid misunderstandings.

- Facilitates International Trade: Necessary for customs to determine the value of imported goods.

- Helps in Financial Planning: Enables buyers to make informed budgeting decisions before committing to a purchase.

Distinguishing from Commercial Invoices

While a proforma invoice outlines proposed transaction details, a commercial invoice is the actual request for payment, issued post-delivery. Understanding this distinction helps small businesses manage financial transactions more effectively.

Crafting Proforma Invoices with Swwitch CRM

Simplifying Invoice Creation

Swwitch CRM's intuitive platform allows small businesses to generate proforma invoices effortlessly. With customizable templates and automated calculations, it ensures that your invoices are professional and compliant with global trade standards.

Key Features:

- Customizable Invoice Templates: Tailor your proforma invoices to reflect your brand and meet specific business needs.

- Automated Calculations: Reduce errors with automatic totaling of quantities and prices.

- Integrated Customer Management: Easily access and insert customer information, streamlining the invoice preparation process.

Enhancing Efficiency and Accuracy

With Swwitch CRM, small businesses can:

- Save Time: Automate repetitive tasks involved in invoice creation.

- Ensure Accuracy: Minimize manual errors in calculations and data entry.

- Streamline Approval Processes: Utilize digital signatures for quick approvals and faster transaction times.

Conclusion: Empowering Small Businesses

Understanding and utilizing proforma invoices effectively can significantly impact a small business's operations, especially those engaged in international trade. Swwitch CRM stands as a powerful ally, simplifying the creation and management of proforma invoices. By adopting such efficient tools, small businesses can focus on growth and customer satisfaction, knowing their invoicing needs are expertly handled.

Optimize your billing process with Swwitch CRM, and ensure your small business is set for success in every transaction.

Get Started with Swwitch CRM for Free. Check swwitch.